crypto tax calculator canada

So for example if you realize a gain of 10000 on selling a few Bitcoins youll only pay capital gains. You simply import all your transaction history and export your report.

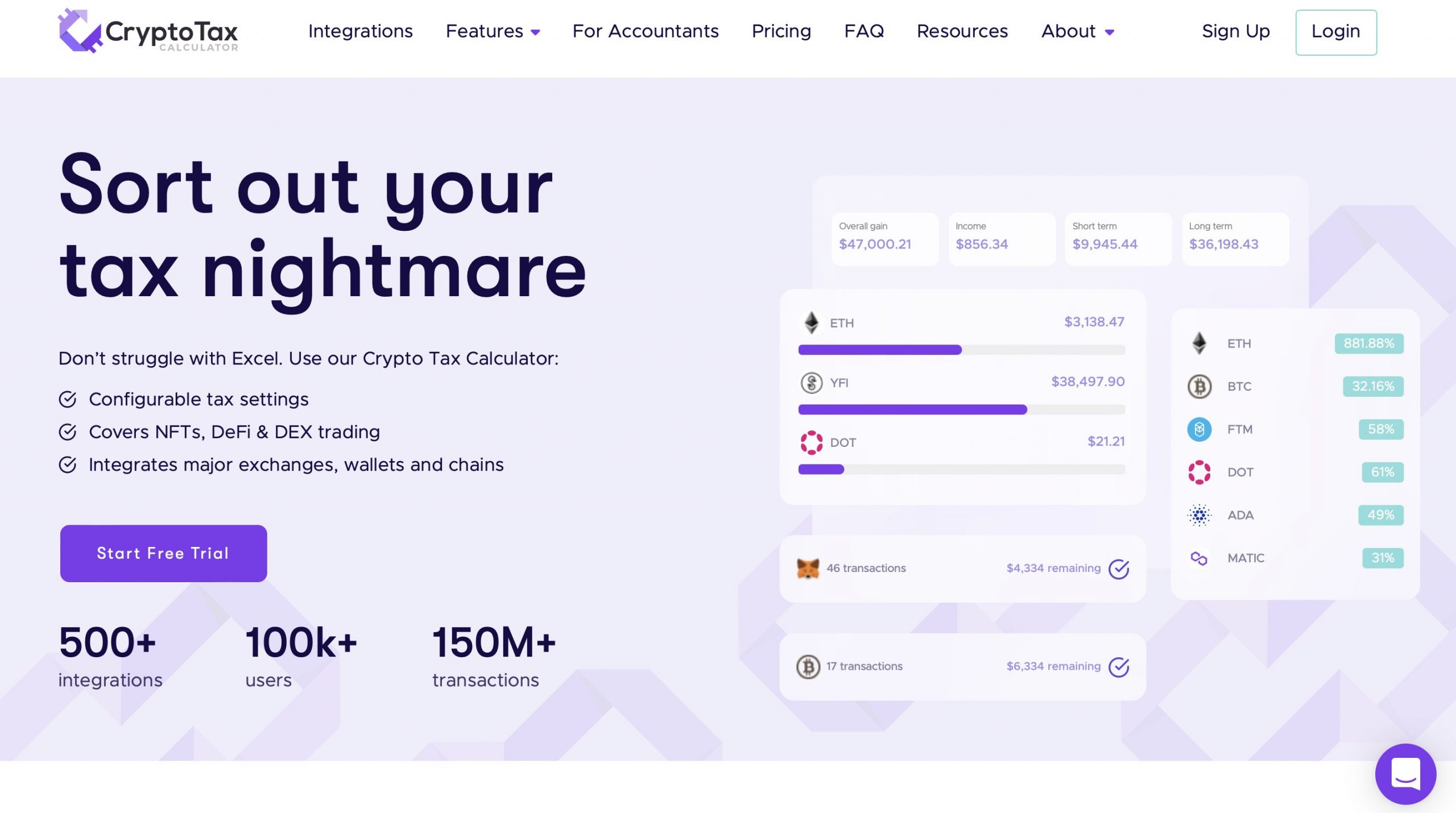

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

. Ethereum Solana and more. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. If thats you the CRA will consider your crypto earnings as income not as capital gains says Hayward and tax you accordingly.

Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts. However it is important to note that only 50 of your capital. By sdg team Tax.

Download your CRA tax documents. Create your free account now. Home Search results for crypto tax calculator canada How to Calculate Capital Gains on Cryptocurrency.

Supports DeFi NFTs and decentralized exchanges. However lets say the capital gains tax rate for your bracket is set at 33. It takes less than a minute to sign up.

Accointing is the most popular crypto accounting software worldwide and one of the best to file tax in Canada. If for instance you. Simply connect your accounts and let CoinLedger calculate your gains and losses across all of your transactions.

Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. This would mean you pay.

Koinly can generate the right tax documents for you. On the crypto transaction of 20000 you will pay tax on 10000 at a rate of 33. For income tax purposes cryptocurrency isRead more.

Jam-packed with features and advanced tools helps HODLers. Once youre done importing you can generate a comprehensive crypto tax. Sort out your crypto tax nightmare.

And by that we mean at a higher rate. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. There are some instances where a crypto transaction may.

Easily share with your accountant or submit online. This means you can get your books. Interestingly only half of your capital gains are taxable.

Does the CRA tax crypto. For example if you have made capital gains amounting to 20000 in a certain year only 10000 will be subject to capital gains tax. NFT Support Track all of your NFT trades.

But remember - youll only pay tax on half your. We handle all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and other DeFi activity. The free trial allows you to.

Whether you are filing yourself using a tax software like SimpleTax or working with an accountant.

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Payroll Taxes

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

11 Best Crypto Tax Calculators To Check Out

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Calculate Crypto Taxes Koinly

11 Best Crypto Tax Calculators To Check Out

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Tax Calculator Overview Youtube

11 Best Crypto Tax Calculators To Check Out

Canada Product Tax Calculator Example Treehouseworldcup Com

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Koinly Review What You Need To Know About This Crypto Tax Calculator